Lessons From 2,000 Church Loans – Insights From Griffin’s 26-Year History

Over the past 26 years, I’ve reviewed tens of thousands of church financials, met thousands of pastors, and sat across from leaders navigating everything from building expansions to crises of foreclosure. After more than 2,000 church loans, clear lessons have emerged — about stewardship, about people, and about how churches grow, struggle, rebuild, and thrive.

This article brings together the most important insights I’ve learned about church lending and church life — the patterns that matter, the warning signs leaders should watch for, and the financial habits that lead to long-term stability.

After more than 26 years and over 2,000 church loans, these church lending lessons reveal the patterns that most influence leadership health, financial stability, and long-term ministry resilience.

Key Takeaways

- Church health is a trend, not a moment. Both decline and growth reveal themselves slowly through patterns long before they show up in financial reports.

- Leadership stability predicts financial stability. More than any other variable, unity and pastoral continuity drive long-term ministry and financial strength.

- Ministry vitality often precedes financial vitality. A spreadsheet cannot capture spiritual renewal, congregational momentum, or the early signs of growth.

- System weaknesses harm churches more than lenders. Inconsistent records, missing policies, and lack of reserves create vulnerability during both growth and crisis.

- Long-term stability beats short-term savings. Fixed, long-term financing protects churches from refinancing shocks and frees ministry from financial anxiety.

- The story behind the numbers matters. Financial ratios inform decisions, but real discernment requires understanding leadership, unity, and the ministry context.

- Stewardship is spiritual leadership. Healthy financial habits, transparency, and planning strengthen both ministry resilience and long-term impact.

1. Why These Lessons Matter

When I started Griffin Church Loans more than two decades ago, I didn’t expect that the real work wouldn’t be lending — it would be listening.

Listening to:

- a pastor explain why giving dipped,

- a board member worried about balloon payments,

- a treasurer unsure how to read financial reports,

- a church recovering from transition or hurt,

- or a congregation preparing to build for the first time.

After thousands of these conversations, I’ve learned something simple:

Church lending is never just financial — it is always personal.

Churches don’t operate like businesses.

Their numbers have meaning, but the story behind the numbers matters even more.

2. The First Lesson: Churches Are Stronger Than Their Numbers Look

One of the biggest surprises from 26 years in this field is how often the numbers underestimate the strength of a church.

I’ve seen churches where:

- the giving pattern looked flat,

- reserves were thin,

- ratios were tight,

- and attendance appeared modest—

Yet the church was full of life, unity, vision, and momentum.

A spreadsheet cannot measure:

- a renewed spirit in the congregation,

- the impact of a faithful pastor,

- a prayer movement,

- a season of healing,

- or the early stages of growth.

Ministry vitality often precedes financial vitality.

And if you don’t understand that pattern, you will misjudge many churches.

This is why we always ask:

“What is God doing here?”

Not just: “What do the ratios say?”

3. The Second Lesson: Decline Begins Slowly — and Rebound Begins Slowly Too

Church decline rarely announces itself.

It shows up quietly, in small changes:

- A slight slip in attendance

- A dip in giving

- A gradual reduction in volunteers

- A shrinking of youth involvement

- A rising tension on staff

Likewise, rebound also begins quietly:

- New families start to stay

- Giving stabilizes

- A ministry catches fire

- Unity returns

- The atmosphere changes

If you only look at quarterly numbers, you will miss these early indicators.

Church health is a trend, not a moment.

Understanding “trend reality” is one of the biggest lessons from watching thousands of churches over decades.

4. The Third Lesson: Leadership Stability Predicts Financial Stability

This lesson has never failed:

**Stable leadership → stable finances.

Unstable leadership → unstable finances.**

I’ve watched churches with excellent facilities, strong history, and good giving patterns struggle simply because:

- leadership turnover

- internal conflict

- unclear vision

- or divided governance

On the other hand, churches with modest facilities and average numbers succeed when:

- pastoral leadership is trusted

- communication is clear

- unity is high

- and the church knows where it’s going

Numbers rise when unity rises.

Budgets strengthen when vision strengthens.

Leadership is the single most influential financial variable in church lending, a reality that aligns with broader research on leadership continuity and organizational performance.

5. The Fourth Lesson: Churches Struggle Most With Two Things — Structure & Surprises

5.1 Structure Problems

These issues show up again and again:

- Weak bookkeeping practices

- Missing or inconsistent financial reports

- Non-existent reserves

- No written financial policies

- No separation of duties

- No multi-year budgeting

These weaknesses don’t just harm loan applications — they hurt ministries.

5.2 Surprise Problems

Two common surprises hurt churches financially:

- Unexpected building repairs

- Leadership transitions

Both can change giving overnight.

In 26 years, I’ve seen more churches fail because of surprise expenses than because of “poor planning.”

Healthy systems aren’t optional — they’re protection.

6. The Fifth Lesson: Long-Term Stability Beats Short-Term Savings

This is a hard truth many churches learn too late.

A short-term loan with a lower initial rate looks attractive — until:

- the balloon payment hits,

- refinancing becomes harder,

- rates change,

- or giving dips unexpectedly.

Meanwhile, long-term fixed loans:

- protect ministries during hard seasons

- stabilize monthly payments

- remove the risk of refinancing shocks

- create sustainability

- increase planning confidence

After thousands of loans, one insight stands out:

The best stewardship decision is often the most stable one, not the cheapest one.

Short-term money creates long-term stress.

Long-term stability creates ministry freedom.

Churches exploring their options often begin by understanding how payment structure affects long-term ministry flexibility, which is why tools like our church mortgage calculator focus on stability, not just rates.

7. The Sixth Lesson: The Story Matters More Than the Spreadsheet

Sometimes the ratios look perfect — but the ministry is stagnant.

Sometimes the ratios look strained — but the ministry is strong.

I’ve seen:

- A church with excellent financials collapse after internal conflict

- A church with average numbers explode with growth because unity returned

- A church with declining giving rebound under new leadership

- A church with limited reserves thrive due to strong volunteer culture

**Numbers inform the decision,

but the story shapes the decision.**

That’s why our process always combines:

- financial analysis

- leadership interviews

- ministry context

- congregational history

- vision for the future

This hybrid approach has served 2,000+ churches well.

These principles are reflected repeatedly in real church lending stories where leadership health and stewardship shaped long-term outcomes.

8. The Seventh Lesson: Stewardship Always Wins

Across thousands of churches, one pattern repeats more than any other:

Healthy stewardship produces healthy ministry.

Not the other way around.

The churches with the strongest long-term trajectories:

- budget wisely

- manage reserves

- plan for facility repairs

- avoid unnecessary debt

- use long-term financing wisely

- communicate openly with their congregation

- invest in leadership

- remain transparent and accountable

Stewardship is not financial management —

it is spiritual leadership expressed through financial wisdom.

Best practices for church financial accountability.

9. The Griffin Perspective: What 26 Years Have Taught Us

When I look back at the last two decades, one truth stands out:

Church lending is ultimately about trust.

Trust that:

- the numbers reflect reality

- the leadership is stable

- the vision is healthy

- the loan structure supports ministry

- and the lender understands churches

That’s why our core approach has not changed:

“Tell them honestly, charge them fairly, and close them quickly.”

Because churches operate on faith —

and our job is to honor that faith with clarity.

After more than 26 years of church lending experience, we’ve learned that trust is built through consistency, clarity, and respect for ministry realities.

10. Practical Takeaways for Pastors and Boards

Here are the most consistent lessons churches can apply immediately:

✔ Keep financial records clean and consistent

It protects the ministry far beyond loan applications.

✔ Build reserves intentionally

Surprises are guaranteed — planning is optional.

✔ Choose long-term stability over short-term savings

Short-term loans are a gamble. Long-term loans are protection.

✔ Watch patterns, not moments

Both decline and growth show up early if you know what to look for.

✔ Invest in leadership health

Unity is the strongest financial engine a church has.

✔ Stewardship is discipleship

The financial culture of a church reflects the spiritual culture.

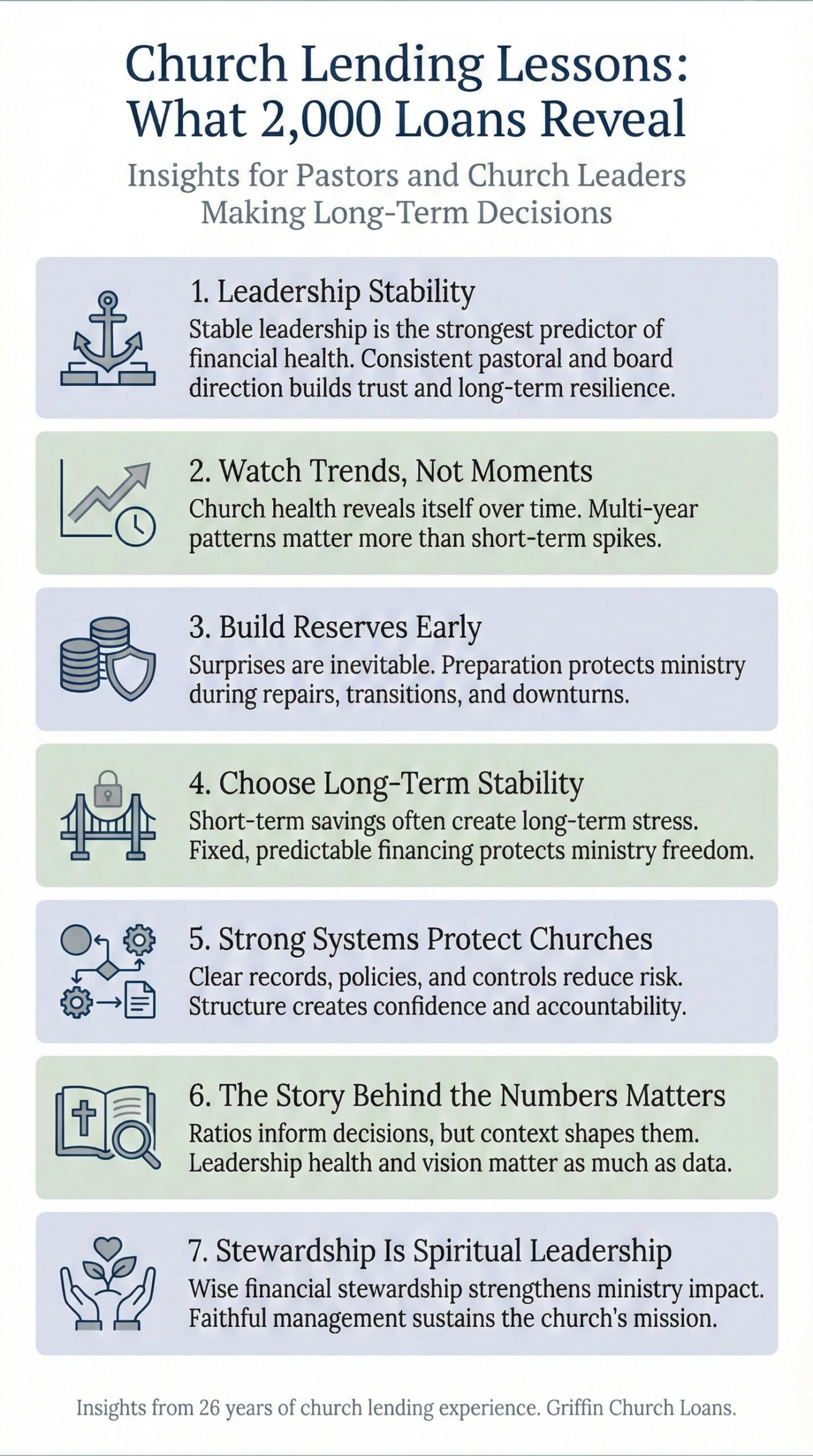

A visual summary of the most consistent lessons Griffin has observed across 2,000 church loans over 26 years.

11. FAQs

11.1: What are the most important financial habits for churches?”

Consistency, reserves, clear records, and long-term planning.

11.2: What is the biggest red flag in church lending?”

Leadership instability — it signals deeper issues.

11.3: How do churches know when to refinance?”

When payments strain ministry or short-term risk is rising or better interest rates are available.

11.4: What makes a church financially healthy?”

Strong stewardship habits, unity, and stable leadership.

12. Final Thoughts

After more than 26 years of walking with churches, I’m convinced of one thing:

**Churches are remarkably resilient —

when stewardship, leadership, and vision work together.**

Numbers rise and fall.

Attendance shifts.

Seasons change.

But the churches that thrive are the ones that steward well, lead well, and stay unified in their mission.

That is the greatest lesson from 2,000 church loans —

and one I hope encourages every pastor, treasurer, and board member heading into 2026.

Further Reading

For readers who want deeper perspective on church financing, stewardship, and leadership discernment, the following articles provide additional context: